Buying a home within a homeowners association comes with its own unique set of benefits, challenges, and costs.

Here’s everything you need to know about them.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

Buying a home within a homeowners association comes with its own unique set of benefits, challenges, and costs.

Here’s everything you need to know about them.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

Stacey Kraft with Home Warranty of America is with me today

to answer some questions on all things seller home warranties today.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

Today’s topic is an exploration into home warranties for sellers and Stacey Kraft from Home Warranty of America is joining us today to lend her expertise in this area. If you missed our first conversation about buyer warranties, take a look here!

Q: First, what is a home warranty?

A: Home warranties are going to cover the mechanical systems in your home, and there’s an acronym that will make it easy to remember each of them: P.E.A.C.H., which is broken down into Plumbing, Electrical, Appliances, Cooling, and Heating.

Q: If I’m a seller, why would I want all of that to be covered?

A: Protection for home sellers is necessary because hiccups can sometimes occur without warning, whether they’re mechanical or otherwise. The last thing a seller wants to worry about when their home is for sale is shelling out money for repairs.

Q: An example of that might be your hot water tank going out. What would a new hot water tank ordinarily cost?

A: I see claim notices every day, and on average, a water heater will run you about $1,000.

Q: A warranty, then, will give a seller peace of mind?

A: Yes, the security blanket that a home warranty offers gives the seller peace of mind, and not only that, it’s a good foundation for when the buyer takes over. Since we have free seller’s coverage on the home, we have a history with it.

“

Protection for home sellers is necessary.

”

Q. From the point of closing and beyond, how long will that coverage last for the buyer?

A: The new-buyer plans are for 13 months or you can buy a two- or three-year plan up front if you wish to.

Q. If an issue were to arise with the home, what would the seller do from there?

A: The seller will call our 800 number and file a claim. Then, our claims representative will set up a time for a contractor to come to the home and assess the situation. If it’s determined that the repair can be accomplished in a cost-effective manner, we’ll repair it. If the issue is beyond repair, we’ll replace the item.

Stacey and Home Warranty of America have always serviced our needs in a highly competent way, and have been quick to action in getting our claims addressed. Without a doubt, Home Warranty of America is a wonderful resource for you if you’re selling your home.

If you have any questions for Stacey, go ahead and give her a call at (248) 330-1076. And if you or someone you know would like help with any real estate needs, please give us a call at 866-OWN-THIS or email us at Team1@KathyToth.com. We look forward to hearing from you!

Why should you have a home warranty? Our go-to warranty expert is here to explain.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

I’m joined today by Stacey Kraft of Home Warranty of America, our team’s expert on home warranties. She’ll be talking with us about why it’s important for homebuyers to get a home warranty when they purchase a home.

A home warranty covers the mechanical systems of your home. To easily remember what’s covered, just think of PEACH: Plumbing, Electrical, Appliances, Cooling, and Heating.

Ideally, coverage should begin at closing—things can and do go wrong in the first week or two of owning a house. Your home is usually being used differently in the beginning, so it’s a good idea to have a warranty from the outset.

Stacey’s company offers 13 months of coverage, while most only offer 12 months. Things always seem to go wrong on day 366, so they give you an extra month as a cushion.

“

Just think of PEACH:

Plumbing, Electrical, Appliances, Cooling, and Heating.

”

If you’re comparing companies, look for things such as age restrictions. If you have a 30-year-old furnace, for example, you want to be able to have it replaced if it goes bad.

I’d like to thank Stacey for giving us some great insight. Feel free to reach out to her at (248) 330-1076.

If you have any questions or would like more information, contact me. I look forward to hearing from you soon.

If you’re ready to sell your home, there are a few things you can do in order to make buyers fall in love with it.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

Are you ready to make a move? There are four ways to make buyers fall in love with your home.

First, make it move-in ready—think clean, organized, and clutter-free spaces. Second, bring in some plants, because greenery adds instant style. Third, up the “dream home” factor and highlight any unique features. Lastly, don’t forget to call your local Keller Williams agent!

If you have any questions or if you’d like to get started with the home selling process, don’t hesitate to give us a call. We’d love to help you.

Would you like to update your home, but you’re worried about sinking a lot of time and money into it?

Here are some quick and inexpensive alternatives.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

As a homeowner, it’s important to maintain your property. However, you don’t always have the time or funds to make the improvements you may desire.

To make things easier for you, we’ve assembled a few quick and easy tips to spruce up your home:

1. Try updating your house numbers. This quick fix will really set you apart from your neighbors and makes your home easier to find. There are many options to choose from, so get creative.

2. Paint an old piece of furniture. This can turn an outdated nightstand or chair into a new stunning addition.

3. Paint your front door. Try something that compliments your house or be daring with a bold color.

4. Seal the sidewalk. Cracks and gaps in sidewalks and walkways can quickly expand throughout the year. Not only will a patch job make your pathway look nice, but it will also make it safer for visitors. Fix your sidewalk and driveway with a patching compound specifically made for cement.

We hope that these suggestions help to improve the curb appeal of your home. If you’d like more tips or any information regarding real estate, don’t hesitate to give us a call or send us an email. We look forward to hearing from you.

Are you ready to sell your home?

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

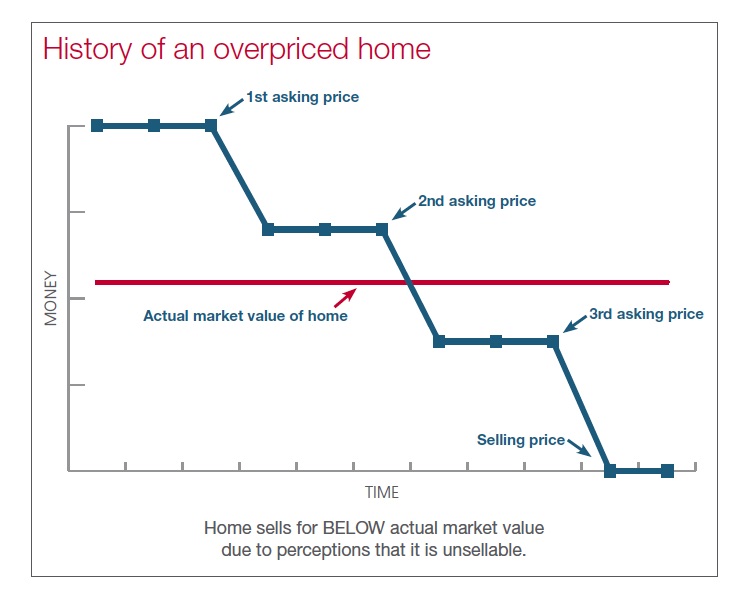

If you would like to sell your Ann Arbor area home this spring, you are most likely already thinking about what your asking price should be. If you’ve already had your home on the market for a while with no success, perhaps you’re wondering what you might be doing wrong. There are lots of pricing misconceptions, and Toth Team Worldwide Network is here to set the record straight!

The simplest breakdown is this: Price + Exposure = Sold. The price is determined by the value of your property. The value is determined by what buyers are willing to pay and what sellers are willing to accept in today’s market. Buyers make decisions based on what other similar properties recently sold for in your area.

The value of your home is not determined by what you paid for the house when you bought it, what you feel you need to get for the house, what you want to get for the house, what your neighbors say you should get for the house, what another agent says, or what it costs to rebuild today. If you price your home based on one of these factors, it may sit on the Ann Arbor real estate market with little to no offers.

It’s important to price your home to sell right when listing because the longer the home sits on the market, the less interest it will gain from potential buyers. On average, most offers are received in the first three weeks on the market. By the fourth week, they start to fall. This is when you’ll want to reevaluate your listing price. The longer your house sits on the market, the more price reductions you may have to offer. This could result in a value loss greater than if you had priced it correctly at the beginning.

“

Price + Exposure = Sold.

”

On average, 60 percent of potential buyers look at properties that are priced at market value from the beginning. If you price it 10 percent above market value, 30 percent of buyers will look at it. If you price it 15 percent above, only 10 percent will look at it. Similarly, if you price it 10 percent below market value, 75 percent of buyers will look at it, and so on.

When you work with Toth Team Worldwide Network to sell your house, we’ll give you examples of the competition, both active and recently sold. We also explain the pros and cons of listing over, under and at the suggested sale price. For example, at the suggested sale price, buyers will notice your home, your home will be found easier in searches, it will bring buyers in, and you won’t have issues with an appraisal.

Whether it’s a buyer’s market, seller’s market or balanced market also makes an impact on home prices. You can find more information about all of this, along with graphs to help you understand it, in this Pricing It Right pamphlet we’ve created for you.

For today’s community spotlight, I’m at Dexter’s Pub to speak with the owner, Peter.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

I know Peter through various business transactions, from me frequenting Dexter’s Pub, and from doing real estate together. We’re good friends, so today I wanted to shine our community spotlight on Peter’s popular and successful business.

According to Peter, who has owned the pub since 1998, the significance of the pub’s name comes from the fact that he feels it belongs to the whole community of Dexter.

There’s a special little story about Dexter’s Pub that not everyone knows about: They have their own resident ghost. Peter says that the ghost occasionally floats through the restaurant and knocks things over, causing general mischief. “You just have to be there to experience it,” he says.

Beyond their supernatural mischief-maker, you also have to be there in order to experience the great American dining, meet the excellent servers, and to enjoy the ambiance.

Dexter’s Pub has a regular menu featuring burgers, fish, pizzas, salad, and pasta. The pub also has daily specials. For example, Monday’s special is all-you-can-eat chicken and cod; Tuesday’s is Italian night; Wednesday’s is a Mexican night; and on Saturdays and Sundays, kids under 12 eat for free.

“

Peter appreciates the support that the community of Dexter provides him, so his generosity is a way for him to give back.

”

Peter’s family is also a part of the business: His wife operates as his accountant, and the rest of the family comes in on weekends to help out wherever they’re needed.

He also likes to be a contributing member of the community, speaking at events, serving as a sponsor for various drives, as well as donating to certain causes. He appreciates the support that the community of Dexter provides him, so his generosity is a way for him to give back.

I like to host the Toth Team’s client parties at Dexter’s Pub, where they offer catering services and pre-ordering options via phone. It’s truly a wonderful establishment.

To reach Peter at Dexter’s Pub, you can call (734) 426-1234 or visit their Facebook page.

For any questions you have about real estate, contact us, your real estate experts, by phone, email, or our Facebook page, at any time. We’re here to add value to your lives and provide support.

Which contingencies can protect you during a vacant land purchase?

Our team has a lot of knowledge on this subject, and we’d like to share some of it with you today.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

When you buy vacant land, it’s important that you avoid vacant land traps. There are a few specific buying blunders to look out for during such a transaction, which we would like to highlight for you today.

The first step you should take in protecting yourself against any pitfalls is to partner with a professional. Otherwise, you could easily encounter expensive issues, each of which we’ll discuss in greater detail in future videos.

Some of the contingencies to consider during a vacant land purchase are:

“

Vacant land is the essence of real estate.

”

There are a number of opportunities for protection associated with each of these, and our team has been very fortunate in helping buyers leverage them during their purchases. Would you rather have an expert or an amateur by your side as you pursue this kind of deal?

Vacant land is the essence of real estate, and our team has a strong track record of success in dealing with this type of transaction. We hope you’ll trust us to meet your goals.

If you have any other questions or would like more information, feel free to give us a call or send us an email. We look forward to hearing from you soon.

While there may be two types of smoke detectors available for your home, replacing them every ten years is encouraged no matter the type. Today we are providing even more fire protection options.

Want to Buy a Home? Search All Homes

Want to Sell a Home? Get a Home Value Report

Did you know that the American Society of Home Inspectors recommends buying a new smoke detector every 10 years? It is news to us, so we thought that we would share more.

To start with you should know that there are two types of detectors. There are ionization and photoelectric which use different types of sensors. Ionization detectors are more responsive to flaming fires. Meanwhile, photoelectric are more responsive to smoldering fires which could mean the difference between getting your family out of a burning house.

Ionization smoke detectors are less susceptible to alarming when you burn your pizza in the oven. You can tell if you have an ionization smoke detector by looking at the model number on the back. If the letter “I” is in the model number or there is any mention of radioactive material, it is an ionization detector.

“

Ionization detectors are more responsive to flaming fires while photoelectric detectors are more responsive to smoldering fires.

”

If you and your tenants really want to be safe, there are some things which you should consider.

1. Install both kinds of smoke detectors.

2. Check the batteries on a regular basis.

3. Install interconnected wireless detectors with battery backup.

4. Alert your phone of any smoke in the house with the Nest functions.

5. Locate smoke detectors in every bedroom and on every floor.

6. It is recommended you change your unit every 10 years.

7. You can install sprinklers in your home.

A member of the Ann Arbor Fire Department recommends Kidde smoke and CO alarms.

For updates on fire safety, you can check the Consumer Product Safety Commission to get the most recent publication. And, if you have any questions about this you can contact your local fire department.

If you have any questions relating to your home or real estate in general, please give us a call, text, or send us an email. We would be happy to help in any way that we can. We look forward to speaking with you soon.

The best way to find a great home is to check where the great school districts are. Schools establish whether an area is a good location to buy a home.

Looking to buy a home? Search all homes

Looking to sell a home? Get a FREE Home Value Report

When buying a house, you should always make an educated decision. But did you know that education has a direct impact on housing values?

Even if you don’t have school-aged children, or if you don’t plan to have children, buying a home in a good school district is still a smart decision. More than any other factor, the quality of a school district establishes whether a location is a good area to buy.

Studies have shown that homes in more desirable school districts hold their value better over time. In fact, even in the face of a recession, good schools help homes in a district retain value longer, as well as rebound faster when the market makes an upturn.

Of course, you will pay more for a home in an excellent school district, but when balanced against the better appreciation rate and resale value, it’s an investment that’s more likely to pay off over time. Additionally, studies have shown that when communities invest in an educational millage, property values rise in correlation with the spending on schools. So buying in an area that values their school district can have an ongoing positive impact on your home value, even if you aren’t sending kids off to school each day.

“Studies have shown that homes in more desirable school districts hold their value better over time.”

When considering where to buy a home, make sure you educate yourself. Fortunately, the internet makes it easy to find what you need. Sites like Education.com, SchoolGrades.org, and GreatSchools.net offer current statistics on school districts across the nation. While you will find test scores, grades, teacher-to-student ratios and demographics, they don’t always tell that whole story. Be sure to also look at a district’s commitment to other areas, such as sports, the Arts and music, and extra-curricular activities. Those are all signs of a community that values and supports their school district.

But statistics can only tell you so much. See what people have to say directly about their schools. Read parent and student reviews and check sites like CityData.comto get insights from locals. Visit local discussion boards or Facebook groups to get a feel for the neighborhood and town, or try to contact a local PTA member. Parenting websites are another good resource, as are local new articles.

Buying a home is one of the most important purchases you will make. So do your homework and be an educated shopper.

Today we are at the Jonathan Club in Los Angeles, and we will be discussing what you need to know about HOAs (homeowners associations) before you buy.

Yes, homeowners associations can be a very big deal, especially if you don’t take the time to learn the facts about your specific homeowners association.

Why?

Every one of them is different, and they each come with a specific set of rules and regulations with which you must abide. If you are going to buy that perfect house, you MUST take the time to research and investigate its homeowners association; otherwise, you could, at some point, lose your home.

But don’t worry—we’re here to help you with that. So here is a quick overview of how a homeowners association works, the do’s and don’ts, the pros and cons of a homeowners association, and the one thing you must ALWAYS do if you don’t want to risk losing your home.

First, what is a homeowners association? The purpose of an HOA is to make and enforce rules and regulations for the properties within a designated subdivision. The association’s goal is to ensure that living in the area or on the property is pleasant for all residents.

Those who purchase a home in a subdivision that has an HOA pay membership dues called HOA fees. They will also be required to follow all the existing and newly voted-in rules and regulations or face fines and penalties.

“

Make sure you read the CC&Rs.

”

When dealing with an HOA, you will want to read Covenants, Conditions, & Restrictions (CC&Rs). These are the rules that are placed on the properties within the HOA-governed subdivision. These rules and limits are determined by a builder, developer, or the managing members of the homeowners association for that neighborhood.

If you decide to live in an HOA neighborhood, you might have to give up some of your rights and freedoms to do so. Therefore, you have to ask yourself a few questions before making that final decision about whether or not you really want to live in that HOA neighborhood. For example:

Any given HOA will have their own individual rules and regulations, so learn what they are for each HOA subdivision you are considering. Just because you learned the HOA rules for that first house you passed on doesn’t mean all are the same. You need to research and investigate the rules and regulations for each different HOA neighborhood.

Most HOA restrictions are related to the following:

Generally, the HOA is responsible for taking care of all the common area maintenance, upkeep, and repairs. For condos, they are also generally responsible for all major exterior replacements like roofs, fencing, plumbing, etc.

If you have any additional questions for me about HOAs or anything else related to real estate, don’t hesitate to give me a call or send me an email. I look forward to hearing from you soon.