We have many folks in Michigan who are waiting to buy or waiting to sell. Is there a cost of waiting? Our preferred lender, Steve, put together the facts below You decide what is best for you! We are here to add value and be your real estate solution. Text us 734-669-0337

This year we have seen a consistent growth on mortgage interest rates. Entering 2018, the national average on a 30 year fixed mortgage rate began at 4.25% and is on pace to exceed 5% by the end of the year. Much of the increase is due to the growing concerns of inflation, as well as a consistently stronger employment outlook. These are two main factors as to why the Federal Reserve continues their aggressive approach on increasing rates, with another increase anticipated in December of 2018.

More often than not, home buyers take a break from their home search over the holidays. With rates only expected to rise in 2019, potential buyers should strongly consider the financial advantages of purchasing now opposed to waiting until the New Year.

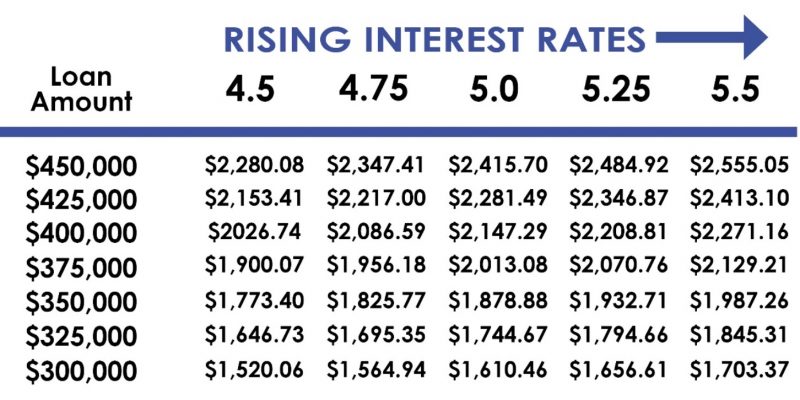

The chart below shows how significant an increase in rates can impact a purchaser’s monthly payment, even if it’s only a quarter of a percent.

Not only does the increase in rates impact the payment, but it can also decrease the amount of financing a purchaser can afford. If a purchaser doesn’t have the ability to offset this with their down payment, it could remove them from qualifying for their desired price range or area. Even worse, the total cost of waiting to buy over a 15 year loan could be $70,000 over the life of the loan.

If you are curious what this potential impact has on your financing scenario, or have someone that you know that would like to discuss details further, please let me know. My team and I are here to help and available 7 days a week.